Frequently asked questions

When will I receive my Rewards vouchers?

You'll receive any M&S vouchers you've earned four times a year. Paper Rewards vouchers are usually sent

in February, May, August and November. Digital Rewards vouchers are usually available 2 months earlier in

March, June, September and December.

You might see your Rewards points balance reduce on your statement before you've received the M&S vouchers.

Remember, you need at least 200 Rewards points in order to receive an M&S voucher. Anything less will be carried over for next time.

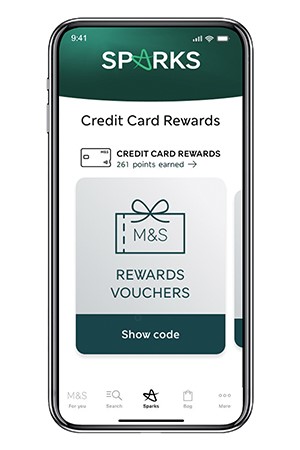

How can I receive credit card Rewards online?

I've lost/had my Rewards vouchers

stolen, can I

receive

new ones?

If you've misplaced your M&S Rewards vouchers or had them stolen, get

in

touch

with us and we'll see what we can do.

To avoid losing vouchers in future, sign up to credit card Rewards online and receive your M&S Rewards

vouchers in your in your Sparks account at marksandspencer.com or in the M&S app.

My Rewards vouchers won't work, what do

I do?

Each M&S Rewards voucher has its own expiry date. For paper Rewards vouchers, make sure that the M&S Rewards

voucher you're trying to use is in date and that you've not already redeemed it. If you're still having trouble

using your M&S Rewards voucher, get in touch with us and we'll see what we can do.

For digital Rewards vouchers in your Sparks account at marksandspencer.com or in the M&S app,

please get in touch with the M&S team who can assist you further.

How can I earn more Rewards points?

With an M&S Credit Card you will earn Rewards points every time you shop.

If you are a member of M&S Club Rewards you'll receive 2 extra Rewards points per £1 spent in M&S when using

your card online and in-store on top of the Rewards points you earn already!

M&S Club Rewards is exclusively available to M&S Credit Cardholders, costing £10 a month to subscribe.

Can I check how many Rewards points I have?

If you're an existing M&S Credit Cardholder, you can check how many Rewards points you have:

- On your monthly statement

- By signing into Internet Banking

- By calling 0345 900 0900 and

selecting 1 for Credit Card, 1 again for 'make a payment'.

After entering some details about your account the automated service will provide you with

your outstanding balance and number of points.

- On your till receipt after making a purchase in a M&S Store.

If you receive your Rewards vouchers digitally, you can also view your points balance within

your Sparks account at marksandspencer.com or in the M&S app.

Do Rewards vouchers expire?

Rewards vouchers do expire. Paper Rewards vouchers are valid for 15 months. Digital Rewards vouchers

in your Sparks account are valid for 17 months, as they’re displayed around two months earlier which gives

you a bit more time to use them.