Money matters with children

In a recent survey*, the vast majority of parents told us they feel it is important to teach their children about money, but over a quarter don't feel equipped to have that first 'money talk'.

Our research found that often it's because parents find it hard to have financial conversations or explain things in a way their child would understand. Many feel unsure how – or when – to approach money matters with children.

To help, here are some tools to support you to talk confidently and openly to children about money.

Six tips for talking money matters with children

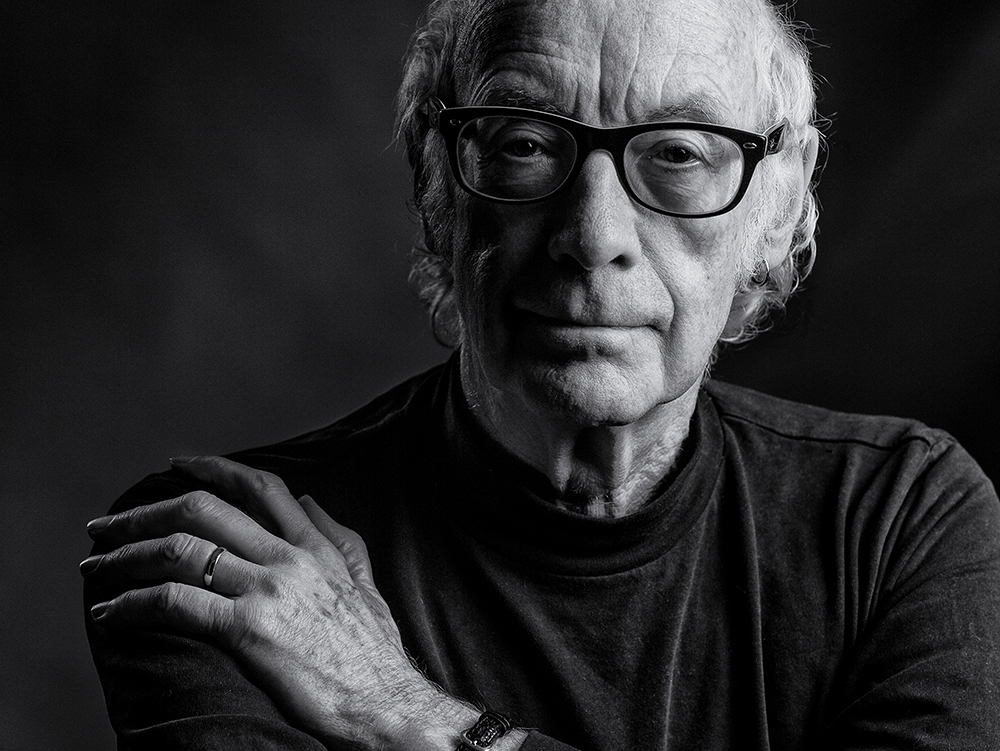

Psychologist Emma Kenny has shared her top tips for teaching children about money, in a way that will help set a positive and confident financial foundation for little ones from an early age.

Introduce your child to the concept of money as early as possible

Whether it's through play or simple observations in and outside of the home - try to look for opportunities to introduce your child to the concept of money. This could be as simple as giving your child their own mini budget to buy something when you do your weekly shop - whether that's a snack or a treat like a colouring book or crayons, enabling them to make choices within their budget. These early conversations are important as they can help your children to understand the concept and value of money, but also help to set a positive and confident financial foundation, which could help them later in life.

Help your child appreciate the value of setting and reaching small goals

Whether you give your child a little pocket money for good behaviour - or for doing small chores around the house, such as keeping their room tidy - earning a small reward helps to bring a sense of satisfaction when they finally reach that all important goal. Psychological studies have shown that delayed gratification is important for children to experience as in the short-term it encourages self-control and patience, while in the long-term, it can help contribute to academic success, social responsibility and a greater capacity for dealing with stress and frustration.

Try using the three 'W's'

When your child asks for a particular item, a practical tool you could use to help them think more about how they are spending their money is the three W's: What is it they want? What is it for? Why do they need it? By using this approach and encouraging your child to answer these questions for themselves, you are encouraging them to consider their choices. This is a life lesson that your child can carry with them as they get older and it will help them develop a sense of gratitude for the items they do receive.

Make learning fun through play

Interactive activities, such as counting money, playing shop or reading a poem or rhyme, are tried and tested methods of helping children to better understand the concept of money. The benefits of bringing learning to life through interactive play are multi-fold and include children becoming better problem solvers - with an increased ability for critical thinking - nurturing creativity and imagination, and building skills such as compromise, conflict resolution and sharing. When it comes to playing shop, to help children learn and engage you could try adding price tags to different priced items, such as toys, alongside everyday items, such as fruit and vegetables, as this will help your child see the value of different items alongside each other. If you're looking for some further inspiration, M&S Bank has partnered with children's poet Roger McGough to create a poem, which helps parents answer some of the most common questions children ask about money – you can read and download the poem.

Show how money can be budgeted and spent in different ways

To help your child understand that the family budget accounts for more than just the physical items they can see – such as the weekly food shop - you could share practical examples of your family budget, that are easy to understand, and that your children can get involved with. This could be something as simple as allocating a small amount each month to a family day out or activity and then involving your children in deciding on what the day out should be – you could explain that if they go for a picnic one month, next month they could all go to the zoo. Not only does this help your child understand the different ways the family budget is spent, it gives them a sense of excitement and responsibility.

Help them understand different ways to pay, such as digital and contactless

One of the challenges parents said they have when teaching their child about money was helping them understand the value of money in the context of digital payments*. To help overcome this, when you next talk to your child about money - or play shop - you could try using a range of different payments - including cashless payments such as contactless and card transactions - so it becomes familiar territory. When you are shopping online, you could also show them how digital payments work.

* Data from a survey conducted by One Poll in July 2020 with a sample size of 2,000 parents.

You can hear more from Emma Kenny in our helpful videos. Simply watch the videos that explore the topics you want to know more about.

Using the "Three Ws" technique (what do you want, what is it for, and why do you need it), Emma Kenny explains how to encourage children to understand the difference between luxuries and essentials.

Video script

Research commissioned by M&S Bank found that four in ten parents believe it’s important to teach their children about money, but are unsure how, and when, they should start the conversation.

It’s important to take the time to talk confidently and openly with children about money, and from an early age – children are quick learners and the sooner you start educating them, the better they will understand the concept and the value of money.

Even with children as young as three years old, techniques, such as the 3 W’s can be used to help set a positive financial foundation.

Simply asking ‘what is it you want, ‘what is it for’, and ‘why do you need it’ helps children to make more considered spending choices.

This is a lifelong tool, and one that will stand them in good stead for future, money management.

Emma Kenny shares how to introduce money to children in a fun and accessible way, including how you can use rhyme to aid learning with help from award-winning poet, Roger McGough.

Video script

M&S Bank research found that six in ten parents felt they should be doing more to help their little ones learn about money, and from an earlier age.

Children love learning when it is interactive and fun, so introducing children to money in an accessible and enjoyable way can really help build good financial foundations from an early age.

An effective way to do this is through play, or through storytelling, rhymes and poetry.

Children love anything that involves rhyme, and they also enjoy the process of learning verses, allowing you to teach them important lessons about the topic of money using a fun medium.

M&S Bank has partnered with renowned children’s poet Roger McGough to develop a poem that you can use to help teach children about money.

Check it out on the website now.

As the world moves further towards a cashless society, Emma Kenny explores how to 'play shop' in a modern way and make sure that children understand the different types of transactions and their value.

Video script

Cashless or digital payments are becoming increasingly more the norm for many of us.

With this in mind, it’s not surprising that M&S Bank found that more than a third of parents are concerned about helping their children understand the value of money in a world of digital payments.

To help children understand different methods of payment –introduce the concept of contactless when playing shop.

Tapping a contactless card at their play shop – as well as utilising coins and notes for some transactions – will help the child to make the connection between the two different payment methods.

Does money really grow on trees?

Poems can help with learning by evoking long lasting memories and understanding. Over a quarter of parents told us that they wished they had a rhyme to use to help teach children about money.

One of Britain’s most renowned children’s poets, Roger McGough, has written 'Does money really grow on trees?' which you can read and learn together with your child.

Read 'Does money really grow on trees?' by Roger McGough(PDF Document)(opens in a new window)

* Survey conducted by One Poll in July 2020 with a sample size of 2,000 parents.