Press Release

26 July 2023

SUMMER SAVERS: M&S TRAVEL MONEY REVEALS THE ALTERNATIVE HOLIDAY DESTINATIONS THAT COULD SAVE FAMILIES THOUSANDS

- A family of four could save an average of £806, or as much as £1,850, on the cost of a summer holiday by considering alternative destinations to popular family holiday locations

M&S Travel Money’s latest best value family holiday destinations research shows that families could see their holiday budget stretch further - saving an average of £806 on a ten-day summer holiday - by considering some budget-saving alternative locations from its list of most popular currency destinations.

The biggest saving can be seen by opting for a family holiday to Sydney, Australia - M&S Travel Money’s fourth most popular currency destination - over fellow Aussie city, Brisbane. Despite both being on the East Coast, and offering up fantastic food and culture, a holiday to Sydney could save families as much as £1,852 (£1,867 vs £2,330 per person), with the main saving coming from flights, which were £459 per person less.

With Sydney having a flight time of around 21 hours, families looking to stay closer to home this summer may consider visiting somewhere in Europe, which is M&S Bank’s most popular currency destination. If thinking of a trip to Mediterranean favourite, Spain, families could save hundreds of pounds by visiting Barcelona vs popular Palma, Majorca, enabling a saving of £930 on their holiday (£344 vs £577 per person). While both offer families access to sandy beaches, Barcelona, which has fascinating architecture, can enable savings of as much as £692 on accommodation for ten nights, when compared to its island alternative.

Another family favourite in Europe is Portugal, opting for the cobbled streets of Porto vs the coastal capital of Lisbon, could save around £455 per family (£437 vs £551 per person).

With the US dollar coming in as the second most popular currency destination, the research also spotlighted family-friendly Florida as a destination for consideration this summer. By opting for the fun-filled Orlando, over the shores of Miami, families could save more than £700 (£769 vs £974 per person), with flights coming out nearly £500 cheaper.

The third most popular currency destination is Turkey, which has long been a family favourite due to its ancient history and turquoise waters. By selecting a ten-day holiday to Antalya, an area known for its Roman heritage and idyllic beaches, families could save nearly £700 (£695), compared to a getaway to the city of Bodrum (£567 vs £741 per person).

For families looking for even warmer climates, the UAE may be a tempting choice and comes in as the fifth most popular currency destination. By opting for a holiday to Abu Dhabi over popular Dubai, families could save an average of £111 (£670 vs £698 per person).

Table 1: Holiday destination swaps - cost of a family of four for 10 nights

| DESTINATION | 2023 HOLIDAY COST FOR FAMILY OF FOUR | TOTAL 'SWAP' COST SAVING PER FAMILY | |

|---|---|---|---|

| SWAP ONE | BUDGET BREAKER Brisbane (Australia) |

£9,321 | £1,852 |

| BUDGET SAVER Sydney (Australia) |

£7,469 | ||

| SWAP TWO | BUDGET BREAKER Palma, Majorca (Spain) |

£2,307 | £930 |

| BUDGET SAVER Barcelona (Spain) |

£1,377 | ||

| SWAP THREE | BUDGET BREAKER Miami, Florida (USA) |

£3,896 | £792 |

| BUDGET SAVER Orlando, Florida (USA) |

£3,077 | ||

| SWAP FOUR | BUDGET BREAKER Bodrum (Turkey) |

£2,964 | £695 |

| BUDGET SAVER Antalya (Turkey) |

£2,269 | ||

| SWAP FIVE | BUDGET BREAKER Lisbon (Portugal) |

£2,205 | £455 |

| BUDGET SAVER Porto (Portugal) |

£1,750 | ||

| SWAP SIX | BUDGET BREAKER Dubai (UAE) |

£2,790 | £111 |

| BUDGET SAVER Abu Dhabi (UAE) |

£2,679 | ||

Helping the holiday budget go even further

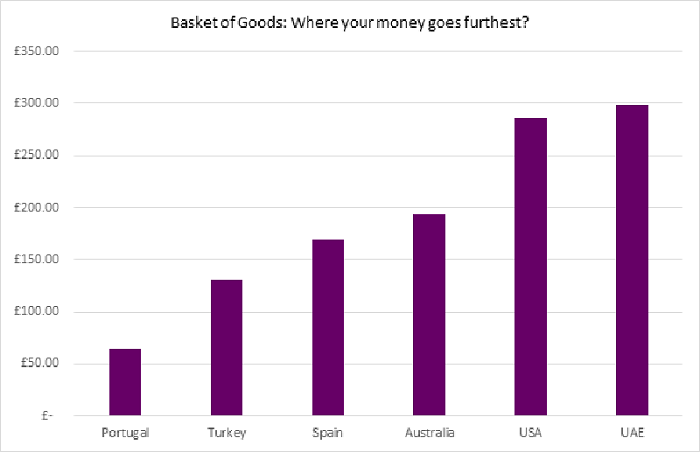

As part of its best value family holiday destinations research M&S Travel Money has compared the price of a ‘basket of goods’ comprising five holiday essentials, including food and drink, that a family might buy while abroad, to highlight which currencies can help their holiday budget go even further.

Portugal has been revealed as the best value destination when it comes to local goods, with a typical ‘basket’ coming in at £65 per person; both a bottle of local wine (an average of £4.21) and waterpark tickets (£31 on average) came in much less than the other destinations researched, as much as 70% and 88% less, respectively, than the most expensive destination (UAE).

Taking a trip to Turkey, would see a typical basket cost £131 per person – 102% per cent more than Portugal, despite being the second best value destination. This destination offered the lowest cost for bottles of water and lunch out, 86% and 74% less than the dearest destination for these items (Florida). This is helped further as the pound is 61% up on the lira, compared to the same time last year.

Meanwhile in sunny Spain, the third best value destination, a basket of goods is priced at an average of £170 per person, while in Australia, this came in at £194 per person. Families visiting Australia will benefit from the pound being 8.5% up on the Australian dollar, compared to the same time in 2022.

While it ranked fourth for value when it comes to local goods, at £286 per person, those visiting Florida could also see their holiday budget stretch further this year, with the pound up 7% on the US dollar, meaning holidaymakers got USD 8 more per £100 compared to the same time last year.

Furthermore, whilst the UAE may have the most expensive basket of goods (£299 per person), the pound also stretches further here compared to this time last year, with families getting 28AED more per £100 converted compared to this time last year.

Table 2: Comparative costs of a popular basket of goods in different holiday desitinations:

| DESTINATIONS | Basket of goods | |||||

|---|---|---|---|---|---|---|

| Water bottle | Local wine bottle | Coffee | Lunch out | Zoo/waterpark pass | Total cost | |

| Portugal | £0.58 | £4.21 | £1.41 | £27.89 | £31 | £65 |

| Turkey | £0.23 | £5.80 | £1.70 | £14.15 | £109 | £131 |

| Spain | £0.64 | £4.87 | £2.00 | £36.52 | £126 | £170 |

| Australia | £1.44 | £11.00 | £2.64 | £41.24 | £138 | £194 |

| Florida | £1.70 | £10.55 | £3.76 | £54.76 | £215 | £286 |

| UAE | £0.48 | £13.86 | £4.24 | £26.60 | £254 | £299 |

Nic Moran, from M&S Travel Money, said: “We understand just how important it is, perhaps now more than ever, for families to make sure they’re getting the most out of their holiday budget. By considering alternative locations to popular family favourites, as well as local costs, families could save thousands, while still enjoying the culture and cuisine they are looking for in the country they would like to visit.”

Nic’s top travel money tips:

- Plan spending money early: Get your spending money organised ahead of time; order your currency online, or visit a high street bureau de change, to secure a rate in advance – and travel with both local currency and a credit card, to ensure you’re covered for all eventualities.

- Consider alternative airports: Flights to airports slightly outside of the destination you’re planning to visit sometimes work out cheaper – but be sure to factor in the cost of travelling to and from the area.

- Travel outside of peak hours: If you can travel at less in-demand times (such as early in the morning or late at night) you may be able to snap up a bargain.

- Don’t leave yourself short when it comes to currency: Ensure you have enough cash for snacks, taxis and tipping, ATMs may not always be readily available.

The M&S in-store travel money bureaux, alongside its euro and dollar Click & Collect travel money service, means an M&S currency service is available in more than 450 M&S stores. The service offers a Click & Collect facility, so customers can order using their Smartphone or tablet – whether at home or in store – and collect in as little as 15 minutes.

ENDS

Further information

For more information about the research, please contact:

mandsbank@instinctif.com

For more information about M&S Bank, please contact:

Louise Wheble on 079204 12086 / louise.wheble@mandsbank.com

Nikki Backler on 079204 17652 / nikki.backler@mandsbank.com

Notes to editors:

All holiday costs are for four people (two adults, two children), for a ten-night stay from 22nd July to 1st August, and include ten nights’ accommodation, round-trip flights to and from London, and one walking tour. All flights/accommodation etc. are booked from 22nd July to 1st August. All flights represent the cheapest direct flight cost (wherever possible), departing from any London airport.

All basket of goods costs were sourced using Expatistan and Numbeo’s cost of living comparison calculators.

Further graphs and tables:

Graph 1: Portugal offers the cheapest total cost for a baskey of goods (including the average cost of a water bottle, local wine bottle, coffee, lunch out, taxi ride and waterpark ticket)

About M&S Bank

M&S Bank (the trading name of Marks & Spencer Financial Services plc) launched in 2012 on the foundations of M&S Money, which was established in 1985 as the financial services division of Marks and Spencer plc. In November 2004, HSBC bought 100 per cent of the share capital of Marks and Spencer Retail Financial Services Holdings Limited.

Today, M&S Bank operates as a joint venture arrangement between HSBC and Marks & Spencer, however, M&S Bank has its own banking licence and its own Board.

M&S Bank offers a broad range of financial products, including the M&S Credit Card, and a range of loans, savings and general insurance products, while its travel money service offers one of the widest ranges of currencies available on the high street.

HSBC UK

HSBC UK serves around 15 million customers across the UK, supported by 26,000 colleagues. HSBC UK offers a complete range of retail banking and wealth management to personal and private banking customers, as well as commercial banking for small to medium businesses and large corporates.